The eNaira, from conception, has followed a careful thought and implementation process, beginning with understanding current realities in Nigeria’s evolving payment landscape, working with clear objectives and principles built from those realities, meticulously laying out the aspects of the architecture and infrastructure and keeping note of real-time risk management protocols.

Built With Attention To Every Critical Detail

Nigeria’s Evolving Digital Payment Landscape

The digital payments scorecard of Nigeria as at 2020 reads: 2.7 billion transactions valued at NGN162.9 trillion, which is 1.06 times larger than the size of the country’s NGN154.3 trillion 2020 GDP. eNaira aims to further increase these figures.

eNaira Objectives supporting Monetary and Financial Stability.

Stability is fundamental to any payment system and at its core, the eNaira is built on this objective and brings a greater level of stability and resilience to the Nigerian payment system.

- Welfare Disbursements to Citizens

- Facilitating Diaspora Remittances

- Improved Efficiency of Cross-Border Transactions

The eNaira provides a clear means for the government to send direct payments to citizens eligible for welfare programs more rapidly, ensuring accountability is achieved, and the right persons get the funds.

In Nigeria, Diaspora Remittances is a key source of foreign exchange, as in 2019, $23.8 billion came into the country. The eNaira provides a secure and cost-effective process for remittances and ultimately boosts remittance flows.

The eNaira gives Nigeria the ability to transact separately, thereby reducing the demand for correspondent banking services and SWIFT international financial messaging and payment systems for the clearing and settlement of trade.

Design Elements

Infrastructure

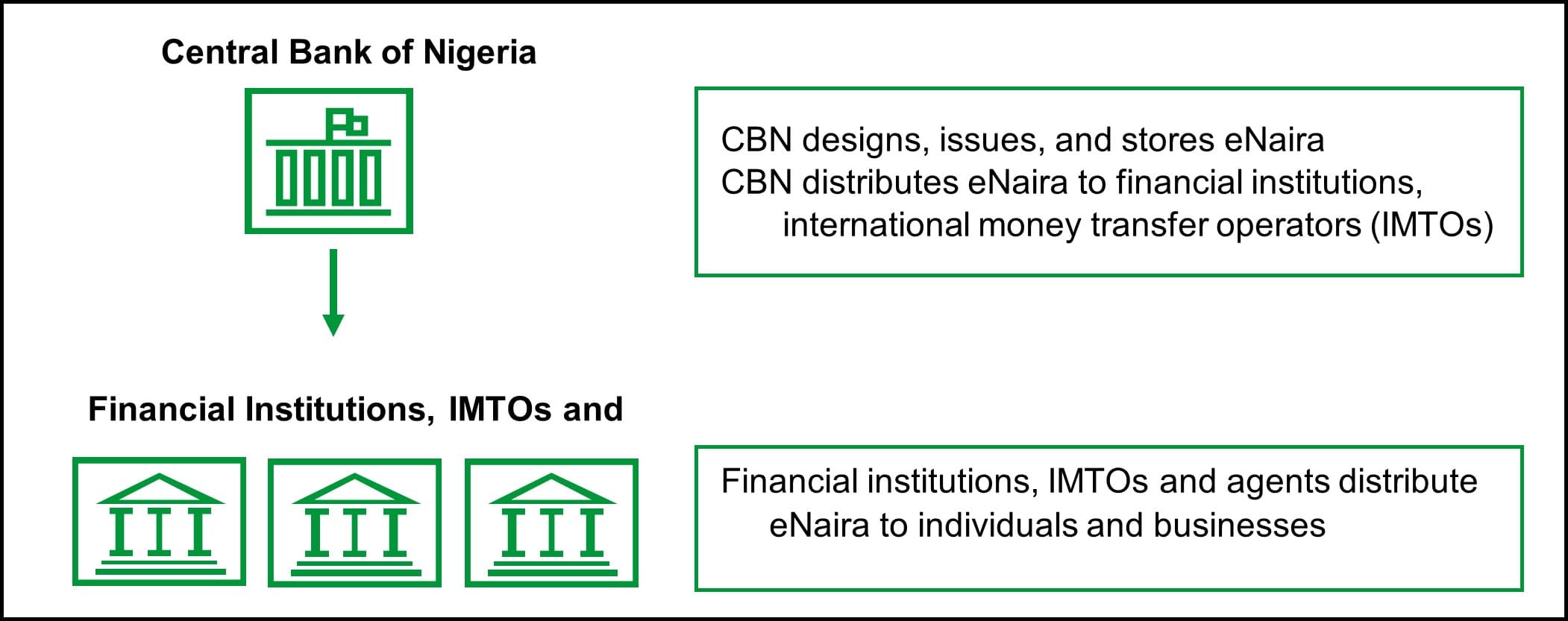

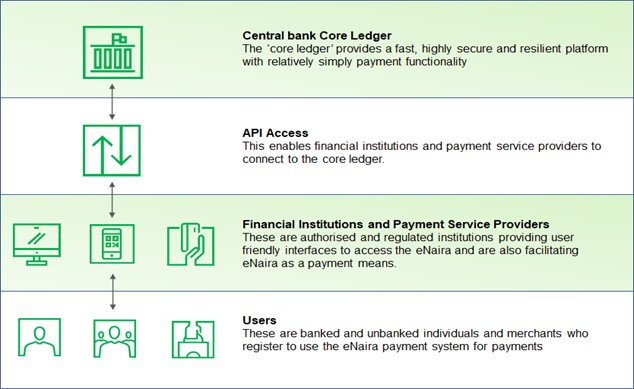

The eNaira infrastructure is based on the distributed ledger technology (DLT) and this supports the two-tiered model architecture which the CBN has adopted.

The Hyperledger Fabric variant of the DLT has been adopted for use as it inhabits the above requirements. The Hyperledger Fabric is an open-source enterprise-grade permissioned distributed ledger technology (DLT) platform, designed for use in enterprise contexts and accommodates the underlying requirements highlighted above. In addition, Hyperledger supports a modular architecture which is a key consideration for the eNaira system, and it has a robust security architecture, is configurable, versatile, optimisable, scalable, and open to innovation

Access

Inclusion is a core objective of the CBN and is highlighted as one the design principles for the eNaira. To ensure inclusive access while also ensuring the integrity of the financial system, the account based CBDC model has been chosen for the eNaira.

The account based CBDC model at its core mirrors the progress made on the National Financial Inclusion Strategy which enables access to financial services by leveraging last mile networks to identify users and to provide banking services through channels such as PoS and USSD. With the account-based model, the CBN seeks to enable access by leveraging the existing identity infrastructure in Nigeria such as the BVN, NIN, TIN, etc., to uniquely identify individuals and corporate entities.

Interoperability

The eNaira has broad use cases beyond the domestic market as it has the potential to avoid fragmentation and promote global cooperation in the long term as well as support a more connected and inclusive world.

Interoperability between the eNaira and other CBDCs has been factored into the overall design of the eNaira. This will help drive the business case for cross-border payments and could potentially address issues of dollarization of the economy which is a key issue that sub-Saharan African countries including Nigeria faces.

Platform Model

About the Model

The design of the eNaira follows a platform model which incorporates the CBN’s design principles. The model entails building a technology platform and leveraging the existing structures and roles in the payment system to deliver additional value for users.

In this model, the eNaira serves as a payment platform on which the financial institutions and payment service providers can innovate and create layered payment services to enable broad use cases for eNaira.

The model at its core drives inclusiveness, innovation and interoperability which are baseline requirements for payment services in Nigeria. Also, to ensure the smooth operation of this model, the CBN has defined regulations to guide all market participants; specifically, regulations around operations, compliance with existing AML/CFT guidelines, privacy and data protection, dispute resolution and consumer protection has been defined.

Payment Functionalities

Wallet Tiers And Transaction Limits

| TIERS | WALLET TYPE | REQUIREMENT | DAILY LIMIT | CUMULATIVE LIMIT |

|---|---|---|---|---|

| 0 | Bronze Wallet | Telephone number | 20,000 | 120,000 |

| 1 | Silver Wallet | National Identification No. (NIN) | 50,000 | 300,000 |

| 2 | Gold Wallet | Bank Verification No. (BVN) | 200,000 | 500,000 |

| 3 | Platinum Wallet | Tier 2 requirement + Public Utility Receipt | 1,000,000 | 5,000,000 |

| 4 | Merchants | Full KYC as stipulated in the CBN’s AML/CFT Regulations | Unlimited | Unlimited |

Interest Earnings And Redemption Of ENaira

The eNaira has been designed to mimic the physical Naira and as such does not earn interests. This aligns with the overall framework of the eNaira which is to complement existing banking products and services and not destabilise the existing system.

The eNaira is a digital representation of the physical Naira and as such shares all its characteristics including its value. The conversion rate for the eNaira to cash is at par, hence 1 Naira equals 1 eNaira.

Regulation

There is a steep learning curve with the eNaira for the CBN and the CBN is open to defining and redefining regulations to promote an open, innovative, and resilient payment system.

Compliance With AML/CFT

The eNaira payment system is compliant with AML/CFT guidelines to ensure the integrity of the financial system. To achieve this, the CBN adopted the account-based CBDC model, and through this, the CBN is able to identify users on the platform using the national identification frameworks, BVN and NIN.

However, considering that the CBN has adopted a platform model to market, it relies on financial institutions and other payment service providers to deliver layered value-added services on the eNaira platform, and as such, the role of AML/CFT checks will also be handled by financial institutions who have close proximity and provide value added services to customers.

Privacy And Data Protections

The eNaira system is built with deep considerations around privacy and data protection and in compliance with the National Data Protection Regulations (NDPR). While users will have control of their data, the eNaira system is designed in line with AML/CFT guidelines in order to guide against the illicit flow and use of funds. This ultimately ensures a safe, trusted, and resilient payment system with high level integrity.

Impact Risk Assessment And Management

Strategic And Policy Risks

The CBN has taken into cognizance these following policy risks that are associated with the eNaira right from implementation, and have created mitigation measures through strategy and policy to address them:

- Risk of Disintermediation, where eNaira users, in converting some of their existing bank deposits into eNaira and holding the eNaira in wallets not held in the bank, can lead to reduction in deposit liabilities and in the availability of funds for bank lending, negative impact on the ability and capacity of banks to lend to the real economy, fall in liquidity and challenges in liquidity management, and fall in credit assets and shrinking balance sheet.

- Exposure of the payment system to uncertainties derived from running parallel with existing Naira payment systems.

- Complexities and the risk of further financial exclusion. As a concept, people are likely to struggle to understand how the eNaira differs from the money in their bank account which is a digital representation of cash deposits. Also, maximizing the value and use cases of the eNaira depends largely on devices with internet capabilities, which risks further alienation of sections of the population who are uneducated, lack exposure and access to internet services or digital devices.

Operational Risks

The CBN has taken into cognizance these following implementation and adoption risks that that could arise from core aspects of design and have created mitigation measures to address them:

- Legal considerations around stakeholder obligations, responsibility for risks and exposures on the eNaira platform, intellectual property rights.

- The central bank’s internal organisation and processes.

- Failed dispute resolution mechanisms resulting in financial losses especially for merchants.

- Reliability, adequacy, and safety of IT Infrastructure to support the eNaira payment system

- Governance and decision making on the eNaira payment system

- Outsourcing and 3rd party risks.

Cybersecurity Risks

As a digital innovation, eNaira faces inherent cybersecurity risks which must be adequately addressed. The introduction of eNaira amplifies cyber vulnerabilities and increases the surface area of attacks to now include central banks. As such, the CBN has taken into cognizance the fact that cybersecurity risks in the form of cyberattacks and illicit financial losses could arise from usage and have created these and more mitigation measures to address exposures and enhance overall security on the platform:

- IT security governance over the eNaira system

- Conducting regular IT security assessments to identify vulnerabilities and harden the system.

- Adhering to traditional security principal cores of confidentiality, integrity, and availability (CIA), together with strong internal control measures. will be implemented.